How the Pandemic and WFH Have Affected Lunch Across the U.S.

May 31, 2023

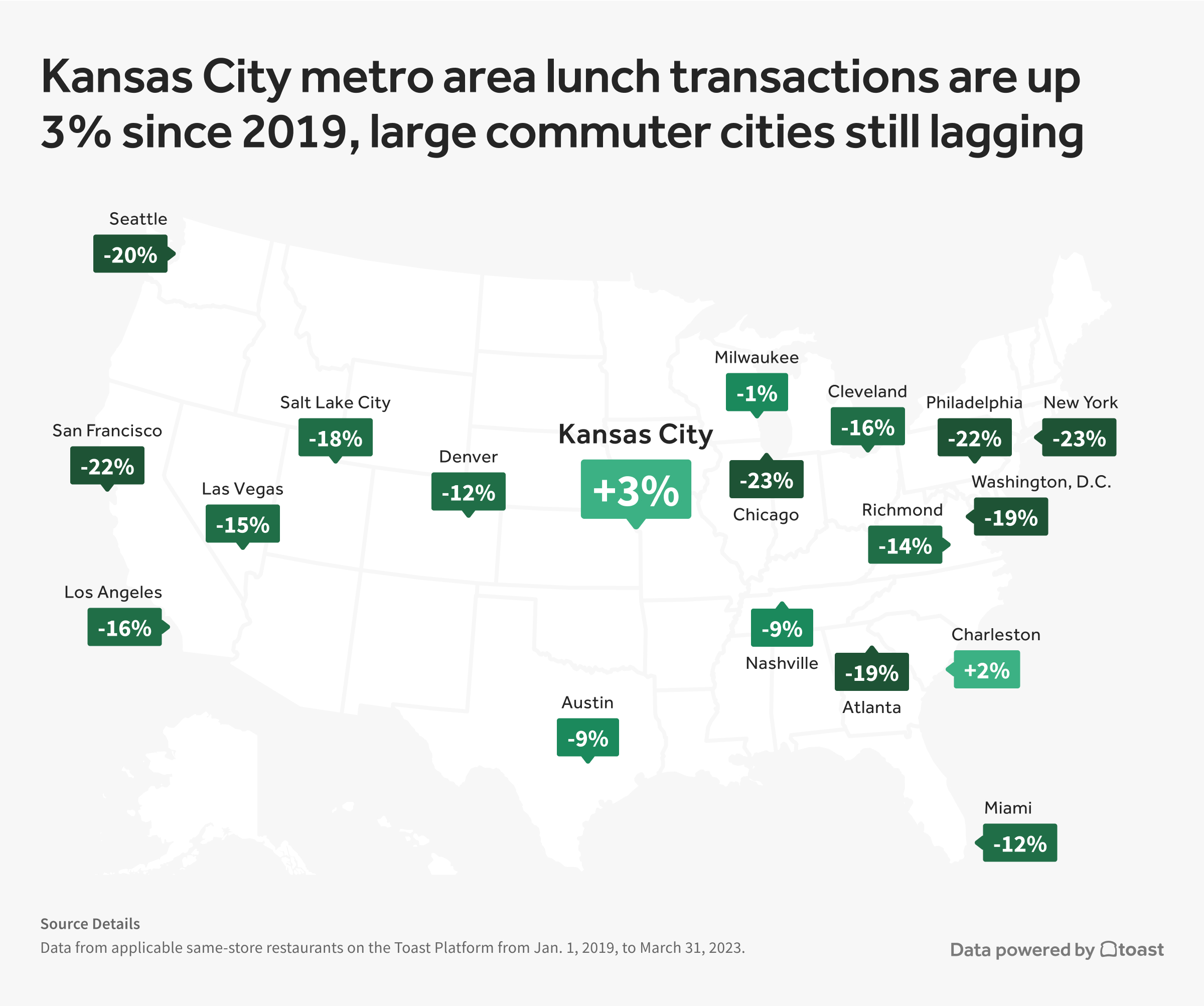

Kansas City and Charleston metro areas exceeds pre-pandemic level lunch transactions, but large commuter areas are still recovering.

BOSTON, MA – Toast (NYSE: TOST), the all-in-one digital platform built for restaurants, today announced its Q1 2023 Restaurant Trends Report, providing insight into the overall state of the U.S. restaurant industry through an analysis of aggregated sales data from selected cohorts of restaurants in select U.S. metropolitan areas on the Toast platform, which serves approximately 85,000 restaurant locations as of March 31, 2023. Read more details about our methodology below.

It’s been three years since the COVID-19 pandemic hit the U.S. As remote work became normalized and some of the most populated cities saw some of the largest decreases in population, this has affected how and where people eat lunch. Let’s dive in and see how things have changed in recent years.

The lunch rush

Just as the pandemic has shifted where people live and work, it’s also affected when and where we dine out. While our 2022 data suggests that full-service restaurant sales have recovered, lunchtime transaction counts are still lagging in some areas of the U.S., particularly in larger commuter areas.

Toast compared the average number of same-store weekday transactions between 11 a.m. and 3 p.m. local time per restaurant location in Q1 2019 and compared it to Q1 2023 to analyze how busy restaurants are at lunchtime. The Kansas City and Charleston metro areas were the only Metropolitan Statistical Areas (MSA) that Toast analyzed that increased weekday lunchtime transactions in Q1 2023 compared to Q1 2019.

In contrast, larger commuter metro areas like New York City, Philadelphia, Chicago, and San Francisco still haven’t fully returned to their pre-pandemic level of weekday lunchtime transactions.

Methodology: Toast analyzed the number of weekday transactions in 19 select metropolitan areas between 11 a.m. and 3 p.m. local time from a cohort of restaurants on the Toast platform from Jan. 1, 2019, to March 31, 2023, to determine the average number of transactions per restaurant location on the Toast platform in Q1 2019 and 2023. Toast used a cohort of same-store customers on the platform since 2019 to demonstrate COVID-19 pandemic recovery trends. Transactions were not adjusted for total transaction volume.

For here or to go?

- The busiest day for weekday lunch is Friday among all U.S. states and the 19 MSAs analyzed.

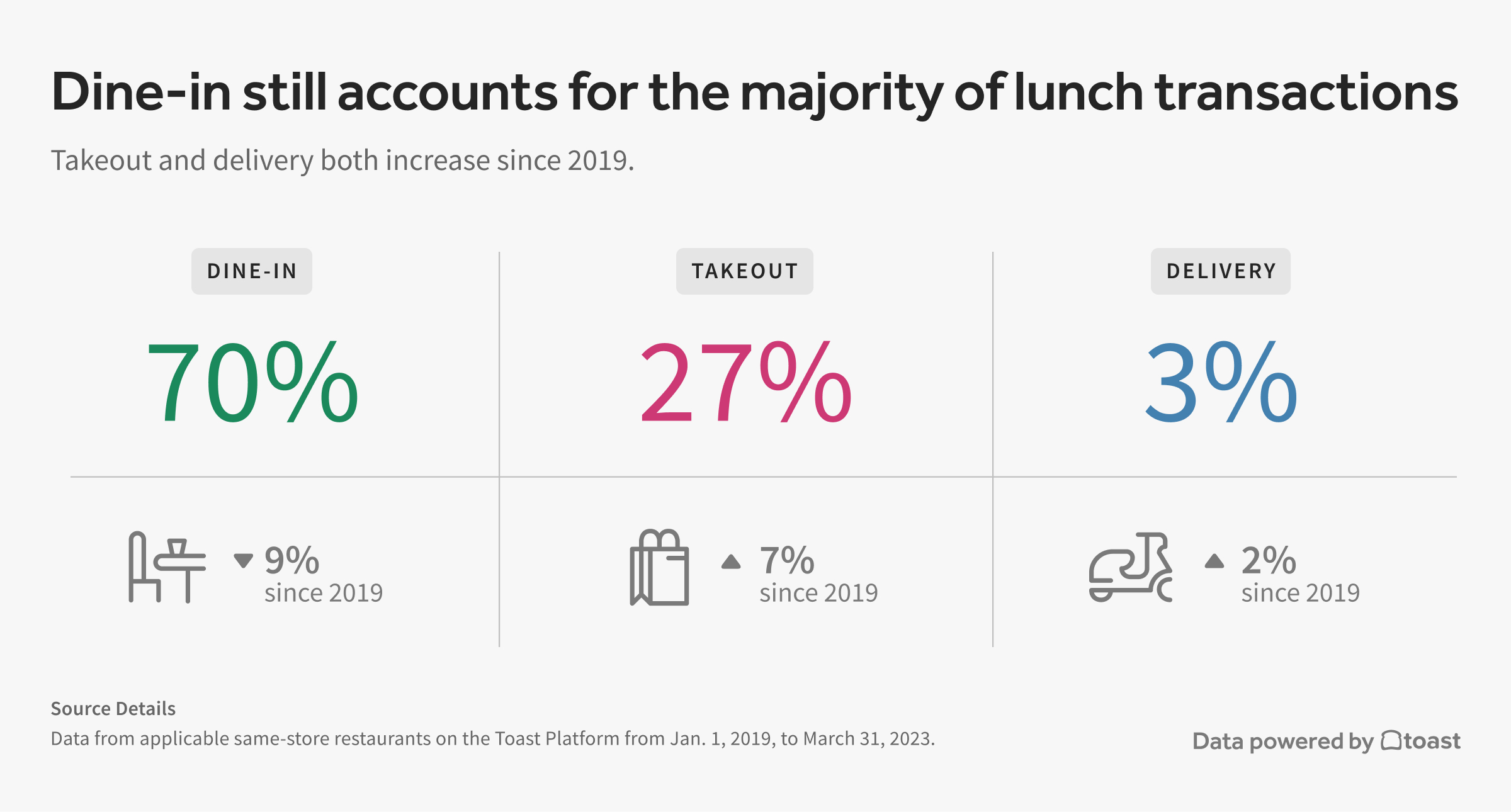

- Dine-in transactions accounted for 70% of transactions during lunchtime in Q1 2023, down from 79% in Q1 2019.

- Takeout transactions accounted for 27% of transactions during lunchtime in Q1 2023, up from 20% in Q1 2019.

- Delivery only accounted for about 3% of total transactions during lunchtime in Q1 2023, up from 1% in Q1 2019.

Methodology: Toast analyzed weekday transactions in 19 select metropolitan areas between 11 a.m. and 3 p.m. local time from a cohort of restaurants on the Toast platform, from Jan. 1, 2019, to March 31, 2023. Toast used a cohort of same-store customers on the platform since 2019 to demonstrate COVID-19 pandemic recovery trends.

Check, please

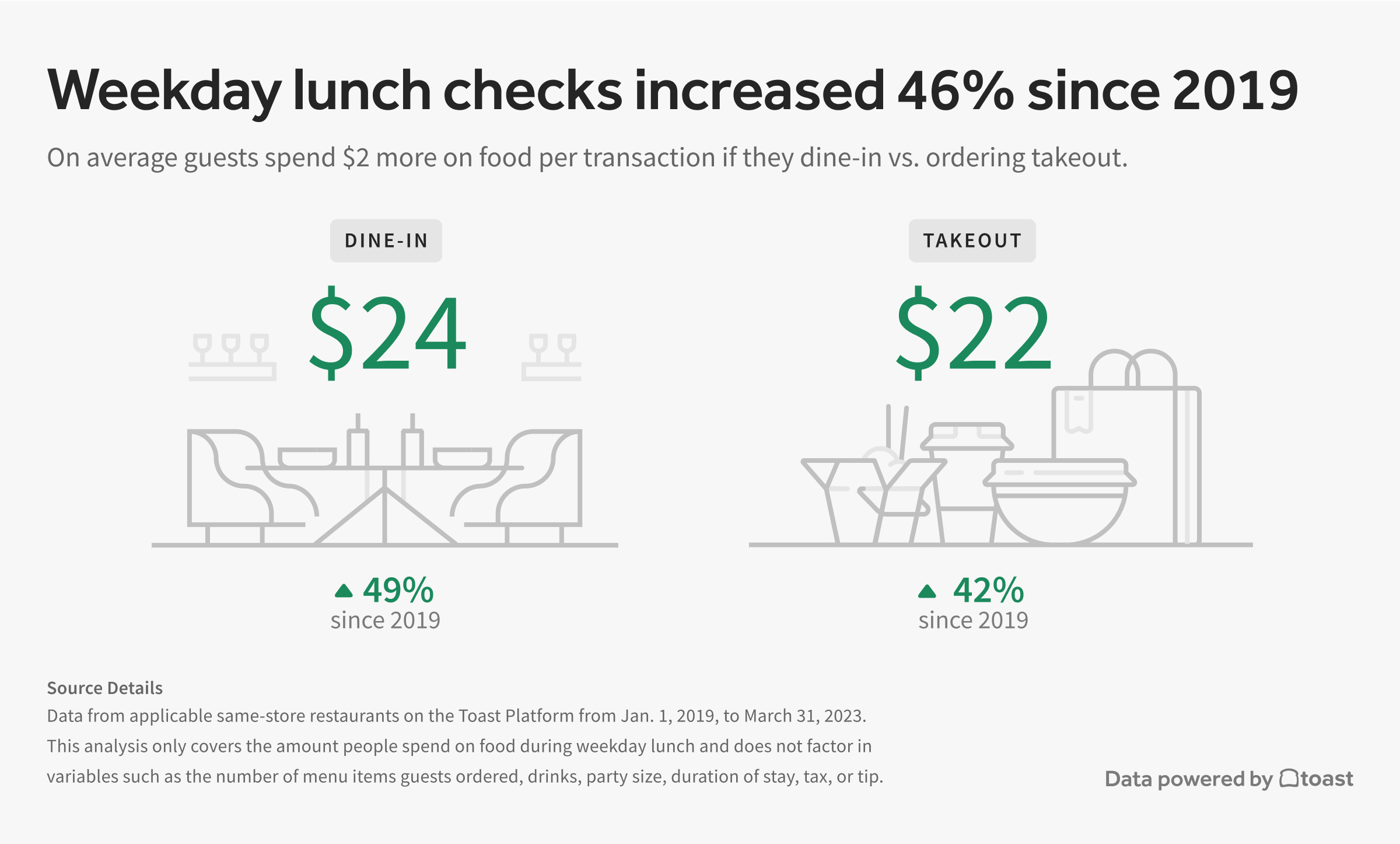

Lunch checks have increased by about 46% in Q1 2023 compared to Q1 2019. According to Toast data, the average spend on takeout food during lunchtime in Q1 2023 was $22 per order, a 42% increase from the same period in 2019. Meanwhile, the average spend on dine-in food was $24 per transaction in Q1 2023, showing a 49% increase from Q1 2019.

Lunch food prices for dine-in at full-service restaurants (FSRs) saw the largest increase, rising from an average of $20 per transaction in Q1 2019 to $31 in Q1 2023, a 53% increase.

Note: This analysis only covers the total dollar amount people spend on food during weekday lunch and does not factor in variables such as the number of menu items guests ordered, drinks, party size, duration of stay, tax, or tip.

Methodology: Toast analyzed weekday transactions between 11 a.m. and 3 p.m. local time from a cohort of restaurants on the Toast platform from Jan. 1, 2019, to March 31, 2023, to determine the average food price per restaurant location (i.e. the Gross Merchandise Volume) in Q1 2019 and Q1 2023. Toast used a cohort of same-store customers on the platform since 2019 to show COVID-19 pandemic recovery trends. Restaurants below a threshold of five transactions a day on the Toast platform were excluded. Analysis only looks at the prices guests paid for food and does not include beverages, tax, or tip.

Lunch: the real happy hour

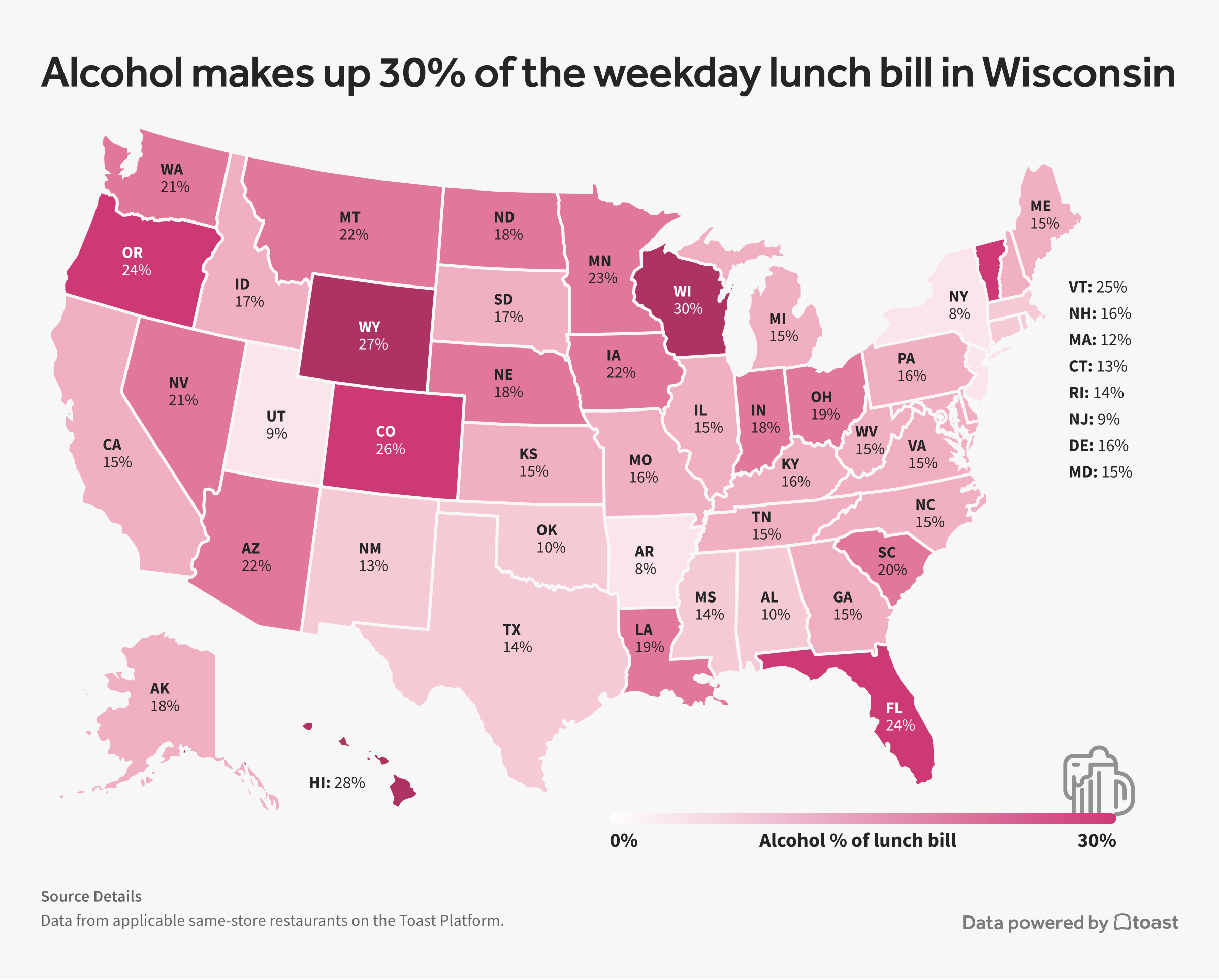

According to our data, some areas of the U.S. adopt the "it's five o'clock somewhere" mentality more than others.

When looking at a mix of metro areas across the country, the Milwaukee metro area tied with the Denver metro area for the highest percentage of alcohol purchases at lunchtime. On average, alcoholic beverages in Q1 2023 made up approximately 26% of items on the average lunch bill in those areas.

At the state level, Toast's analysis of weekday transactions showed that Wisconsin had the highest percentage of alcohol purchases during lunchtime compared to any other state. On average, alcoholic beverages in Q1 2023 made up approximately 30% of items on the average Wisconsin lunch bill, almost twice the national average of 16%. According to the Wisconsin Department of Health Services, it ranks third in the country for the percentage of adults that currently drink alcohol, behind Washington D.C. and New Hampshire.

Methodology: Toast analyzed weekday transactions during lunch service at restaurants on the Toast platform in Q1 2023. Restaurants below a threshold of five transactions a day were excluded. Taxes and tips are not included.

The cost of making avocado toast

Inflation has been a roller coaster, but thankfully the cost of some items is beginning to cool off. Let’s look at how that can impact a popular brunch item, avocado toast, by analyzing invoices from restaurants using xtraCHEF by Toast. (Note: The price of bread is not included in this analysis.)

- Assuming a restaurant uses one-half of an avocado per order, avocado toast was 41% cheaper to make in March 2023 than in March 2022.

- Add two slices of bacon to that order, bacon avocado toast was 27% cheaper for a restaurant to make in March 2023 than in March 2022.

- Top that with one egg, a bacon avocado toast with an egg was 16% less expensive for a restaurant to make in March 2023 than in March 2022.

Why? Here are our theories:

- A temporary ban on imported avocados from Mexico led to a rise in avocado prices in 2022. The ban has since been lifted, and according to the California Avocado Commission, historic rainfalls in the state have been a benefit to its growing season.

- Egg prices reached an all-time high in January 2023 due to an avian bird flu outbreak, but prices have since dropped significantly and are expected to continue to decline.

- Bacon prices have also cooled after reaching a high in September 2022. Experts attribute labor shortages and supply-chain issues spurred by the pandemic for the rise.

Methodology: Toast analyzed monthly invoice items for bacon, solid eggs, and avocados from restaurants using xtraCHEF by Toast. Items were weighted by the frequency of orders, not quantity.

Tipping

How people tip for services has been the source of much media attention in the last year, partially fueled by the proliferation of digital payments and the new trend of being prompted to tip for services that historically did not request tips, like a convenience store transaction or a plumber’s services.

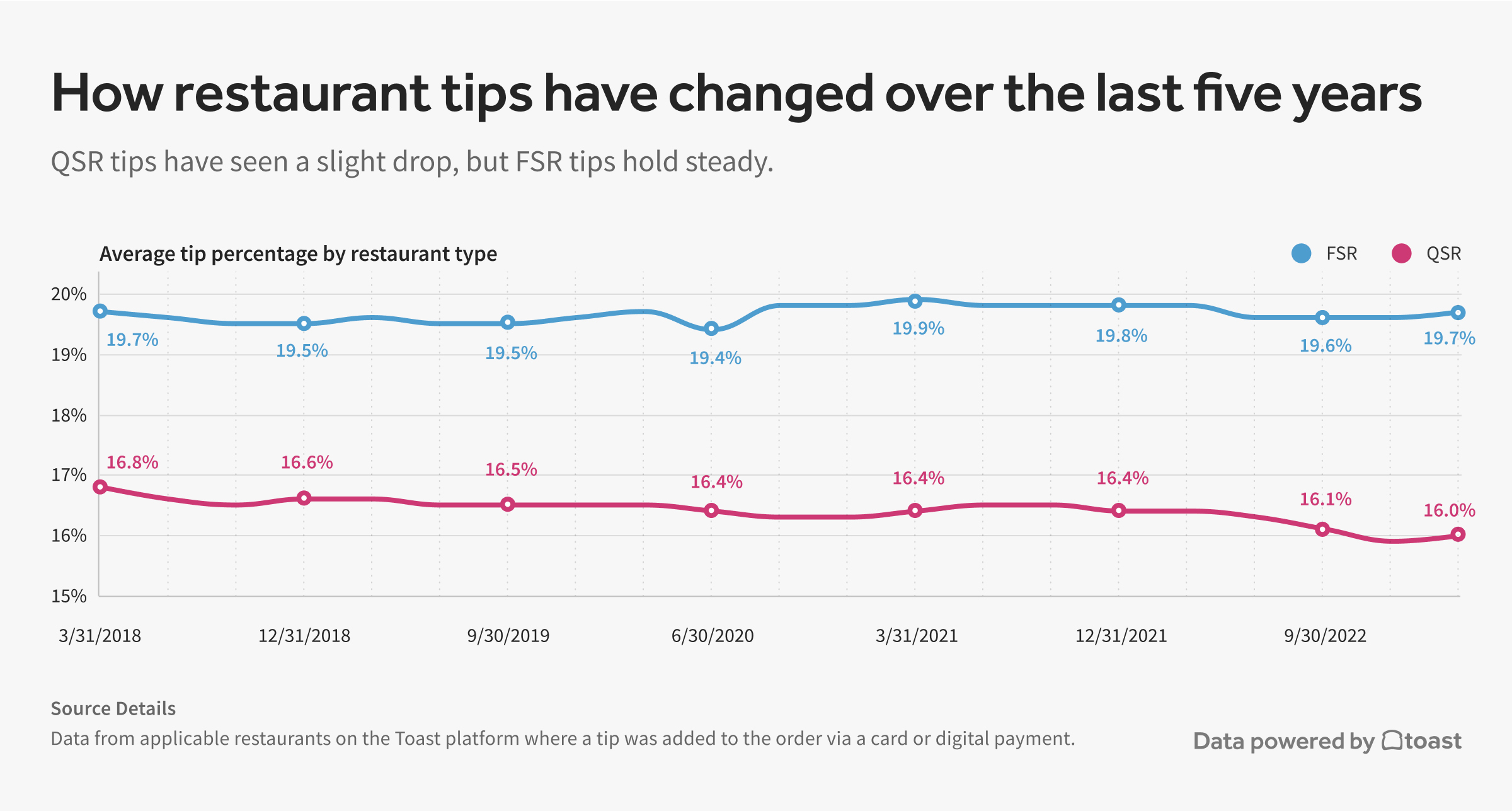

While restaurants may adopt different business models, typically restaurants in the U.S. have accepted tips, especially in full-service restaurants. Toast analyzed tips for quick-service restaurants (QSRs) and full-service restaurants (FSRs) to see if there has been any significant change since 2018.

Note: All tipping data from Toast is collected where a tip was added to the order via a card or digital payment. Cash tips are not included in the analysis.

Methodology: Data from applicable restaurants on the Toast platform where a tip was added to the order via a card or digital payment. Toast compared restaurants using the Toast platform from Q1 2018 to Q1 2023. Cash tips are not included in the analysis.

Since 2018, full-service restaurant tips have ranged from 19.4% to 19.9%, with the most dramatic shift between Q2 2020 and Q3 2020 — the start of the COVID-19 pandemic.

Quick-service restaurant tips have dropped slightly, dipping from a high of 16.8% in Q1 2018 to 16% in Q1 2023. However, as we reported last quarter, our data suggests that guests using a card or digital payment method are choosing to tip at QSRs more frequently than they were in 2020.

Further data analysis indicates guests are leaving lower tips when dining in at QSRs than they used to. The average on-premise tip for QSRs has declined to 16.7% in Q1 2023, the lowest in five years. Tips for delivery and takeout at QSRs dropped to 13.9% in Q1 2023, a similar rate to before the pandemic.

Across the country, tips can vary based on several factors, such as minimum wages for tipped employees, cost of living, taxes, and the type of service. California and Washington State for instance, have some of the lowest tippers, according to our data, but one of the highest minimum wage laws for tipped employees, according to the Department of Labor.

Methodology: Data from applicable restaurants on the Toast platform where a tip was added to the order via a card or digital payment. Cash tips are not included in the analysis.

Looking at Florida, for example, the Miami metro area had an average tipping rate of 16.4% in Q1 2023, which is 2% lower than the average tipping rate for Florida as a whole. Restaurants in international tourist cities, such as Miami, may be more inclined to include a service charge or gratuity on the bill, which could account for its relatively low tipping rate, as people will likely tip less if there is an automatic additional charge on the check. In Florida, restaurants that automatically charge a gratuity are currently required to “include on the food menu and on the face of the bill provided to the customer notice that an automatic gratuity is included.”

For the second quarter in a row, Delaware has the highest average tip percentage at 22%, more than a full percentage point ahead of Indiana.

Methodology: Data from applicable restaurants on the Toast platform where a tip was added to the order via a card or digital payment. Cash tips are not included in the analysis.

Methodology: The Restaurant Trends Report, powered by Toast, uncovers key trends across the restaurant industry through aggregated sales data from a selection of cohorts of restaurants on the Toast platform, which has approximately 85,000 locations as of March 31, 2023. All growth rates are calculated on a same-store sales basis for the applicable period of time. The Restaurant Trends Report is not indicative of the operational performance of Toast or its reported financial metrics, including GMV growth and same-store GMV growth.

This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Individual results may vary. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

About Toast

Toast [NYSE: TOST] is a cloud-based, all-in-one digital technology platform purpose-built for the entire restaurant community. Toast provides a comprehensive platform of software as a service (SaaS) products and financial technology solutions that give restaurants everything they need to run their business across point of sale, payments, operations, digital ordering and delivery, marketing and loyalty, and team management. We serve as the restaurant operating system, connecting front of house and back of house operations across service models including dine-in, takeout, delivery, catering, and retail. Toast helps restaurants streamline operations, increase revenue, and deliver amazing guest experiences. For more information, visit www.toasttab.com.

Contact

[email protected]