Navigating the Employment (Allocation of Tips) Act

Chris FletcherAuthor

Tipping is a lifeline for hospitality workers. I spent the early part of my career filling a Pringle jar each night with my tips from the section I ran in a restaurant in a central London hotel. My wages were okay, but my tips funded my social life! As I continued my career, my tips, or control over them, became more confusing and less transparent. To the point where customers would question, "Do you get this money or does it just go to the business?”.

In an overhaul of tips and gratuity practices, a new law being introduced this year will make it illegal for employers to withhold tips from workers. The new rules will allow more than two million workers to keep a total of £200 million a year in tips, according to government estimates.

These changes will be included in the Employment (Allocation of Tips) Act 2023, which received Royal Assent in May 2023. The rules are due to come into effect on July 1, 2024, and will affect the hospitality businesses across England, Scotland, and Wales.

In this comprehensive guide, we will explain the Employment Allocation of Tips bill, explore how it may impact your business operations and what amendments you can make.

Restaurant Metrics Calculator

Use this free calculator to calculate the key restaurant metrics needed to understand the health and success of your business.

Understanding the Employment (Allocation of Tips) Act 2023: What Does It Mean for You as an Employer in the Hospitality Sector?

The Employment (Allocation of Tips) Act focuses on two primary objectives: 1) ensuring that 100% of gratuities, including qualifying tips and service charges, left by customers reach workers and 2) that the allocation of these funds is conducted fairly. What is considered ‘fair’? That will be outlined in a new statutory Code of Practice for employers to ensure they have clarity on fair allocation.

The employment law primarily addresses "employer-received" tips, covering non-cash gratuities left via card or as a discretionary service charge over which the employer has initial control. It also extends its reach to cash tips that are subject to employer control.

Recognising the overarching goals of the employment law is the first step in understanding its implications. It strives to establish a fair and transparent system, ensuring that gratuities directly benefit workers and eradicating any potential for misallocation.

Here are ten key points to know about the new legislation:

1. 100% Pass Through to Workers: The Act mandates that 100% of gratuities left by customers must be passed on to workers, emphasising the direct flow of funds from customers to the intended recipients.

2. Prohibition of Deductions for Administration Costs: Operators are explicitly prohibited from making or taking any deductions to cover administration costs, such as card fees or payroll expenses. This ensures that the entire gratuity amount reaches the workers without any deductions.

3. Venue-Specific Allocation: All gratuities paid at or attributable to a single venue must be allocated among the workers at that specific venue, promoting fairness within each establishment.

4. Inclusion of Non-Customer-Facing Workers: Non-customer-facing workers can receive an allocation of gratuities from a site, recognising the contributions of various staff members within the establishment, beyond those in direct contact with customers.

5. Fair Allocation Mandate: The Act explicitly states that all gratuities must be fairly allocated, contributing to a more just and equitable workplace. Tips must be allocated fairly between all workers, including those on zero-hour contracts.

6. Timely Payment to Workers: Gratuities must be allocated and paid to workers no later than the end of the month following the month they were received from the customer, ensuring a prompt distribution of earnings.

7. Employer's Moral Responsibility: While not a requirement of the Act, employers are encouraged to "step in" or "challenge" a troncmaster if fair allocation is not apparent or if there is a perceived compliance risk, emphasising moral good practice.

8. Entitlement for Agency Workers: The Act extends entitlement to agency workers, who will now be entitled to a share of gratuities in the same way as employees.

9. Prohibition of Salary/Wage Negotiation: The Act prohibits negotiating with a worker or varying their contractual salary/wages in return for a share of gratuities, ensuring consistency in workers' overall compensation.

10. Government's Commitment to Fairness: The government has given an undertaking to provide a new code of practice following the Act's passage, focusing on fairness, and will undergo its own consultation period and parliamentary approval.

Troncs and Compliance

Businesses with existing tronc arrangements will find that new legislation conditions are automatically met; however, you must be able to prove that there is an independent and compliant tronc arrangement in place.

To align with the new legislation, businesses must maintain a written policy explaining how gratuities are collected and allocated to workers. This policy, meeting the terms of the Act, should be made available to workers upon request. Additionally, meticulous records of qualifying gratuities received and paid out must be maintained for a three-year period.

Policies & Records

To align with the new legislation, businesses must maintain a written policy explaining how gratuities are collected and allocated to workers. This policy, meeting the terms of the Act, should be made available to workers upon request. Additionally, meticulous records of qualifying gratuities received and paid out must be maintained for a three-year period.

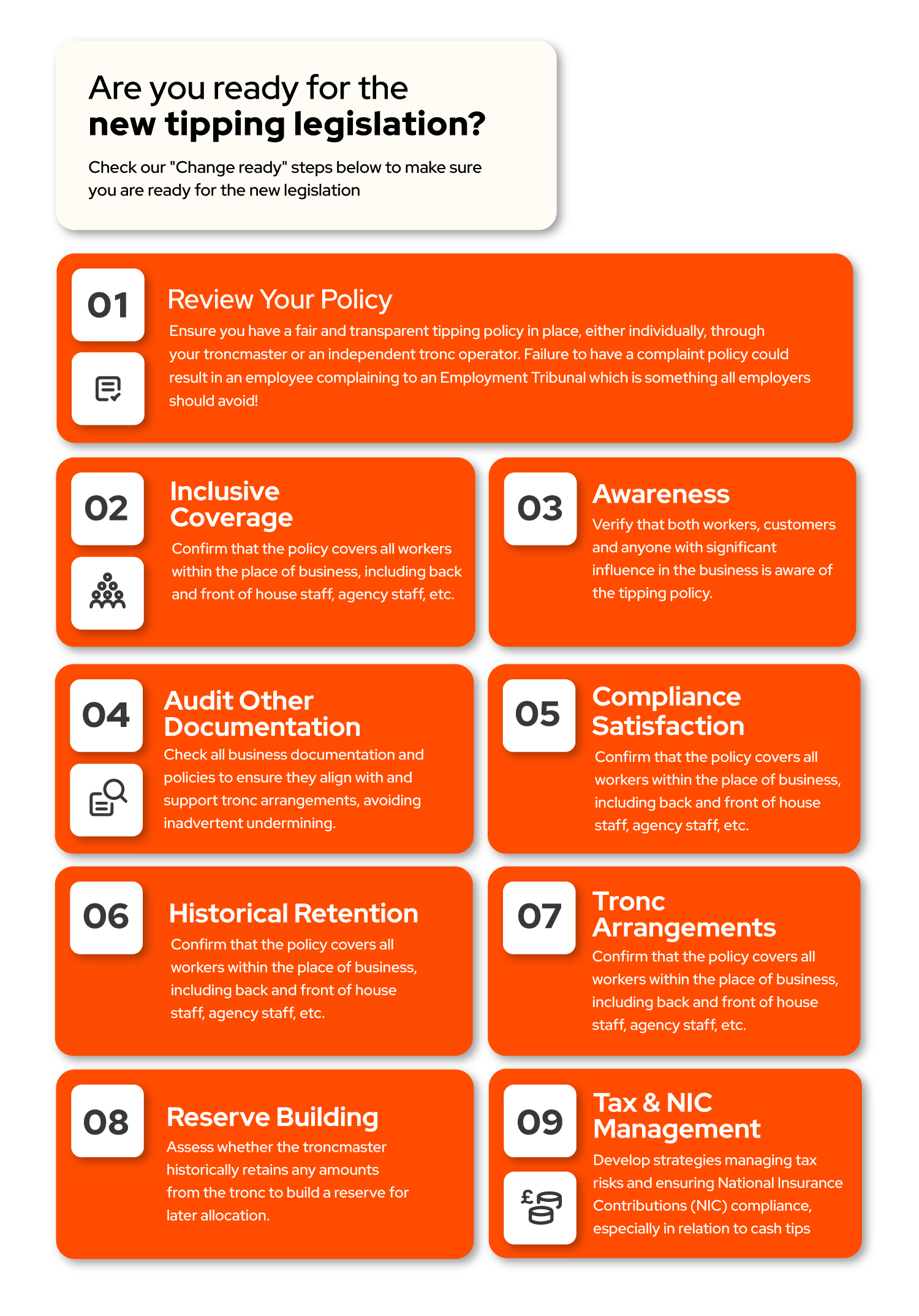

In preparation for the new legislation in 2024, consider the following tips:

Get ready, and ask for help if you need it.

Ensuring you are ready for the Employment (Allocation of Tips) Act is essential for businesses in the hospitality sector. By understanding the intricacies of the legislation and implementing necessary changes, businesses can create a fair and transparent system for the distribution of gratuities.

The draft code of practice is being consulted on until February 22, 2024, so there are likely to be updates before the new law is introduced in July. Meanwhile, the government says further guidance will be published this year to help employers and their workers interpret the legislation.

Stay informed, update your policies, and embrace these changes to foster a positive working environment for your team and enhance customer satisfaction. Toast POS can help you unlock tipping insights and get real-time data to ensure you are upholding your policy on distribution of tips.

If you need any advice, you can reach out to your local Toast rep here, and we can help guide you through the changes.

A POS platform built to grow with your restaurant

Running a restaurant is hard. Using Toast isn’t. See how Toast differs from other point of sale platforms and get a customized walkthrough for your unique needs.

Want to see Toast in action?

Are you a Toast customer? Log in to Toast.

By requesting a demo, you agree to receive automated text messages from Toast. We’ll handle your info according to our privacy statement. Additional information for California residents available here.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.